Mineral economics is an academic and applied discipline that sits at the intersection of economics, geology, engineering, policy, and geosciences. It studies the complete lifecycle of mineral commodities from discovery and exploration to planning, extraction, utilization, waste recycling, and eco-friendly disposal.

This field is crucial in today’s world, where minerals serve as the backbone of industries ranging from construction and manufacturing to renewable energy and digital technology. Mineral economics draws from multiple fields, including geosciences, economics, and business, to address the complex challenges facing these industries.

In this guide, we will unpack the meaning of mineral economics as a topic that bridges multiple academic and professional fields, explore its history, outline key areas of focus, and analyze its role in global trade, sustainability, and real-world mining projects. By the end, you’ll have a well-rounded understanding of why mineral economics is essential for both industrial development and environmental stewardship.

What is Mineral Economics (and Why Does it Matter)?

Mineral economics examines how mineral resources are discovered, developed, priced, traded, and consumed. It integrates technical, financial, and policy considerations to ensure efficient and sustainable mineral use.

Minerals are finite resources that form the foundation of modern economies. Without strategic management, industries risk facing supply chain disruptions, volatile pricing, and unsustainable exploitation of natural resources.

Mineral economics matters not only to governments and businesses but also to societies. Various organizations and disciplines are concerned with issues such as supply chain integrity, sustainability, and economic impact. For instance, minerals like copper, cobalt, and lithium are vital for renewable energy technologies and electric vehicles.

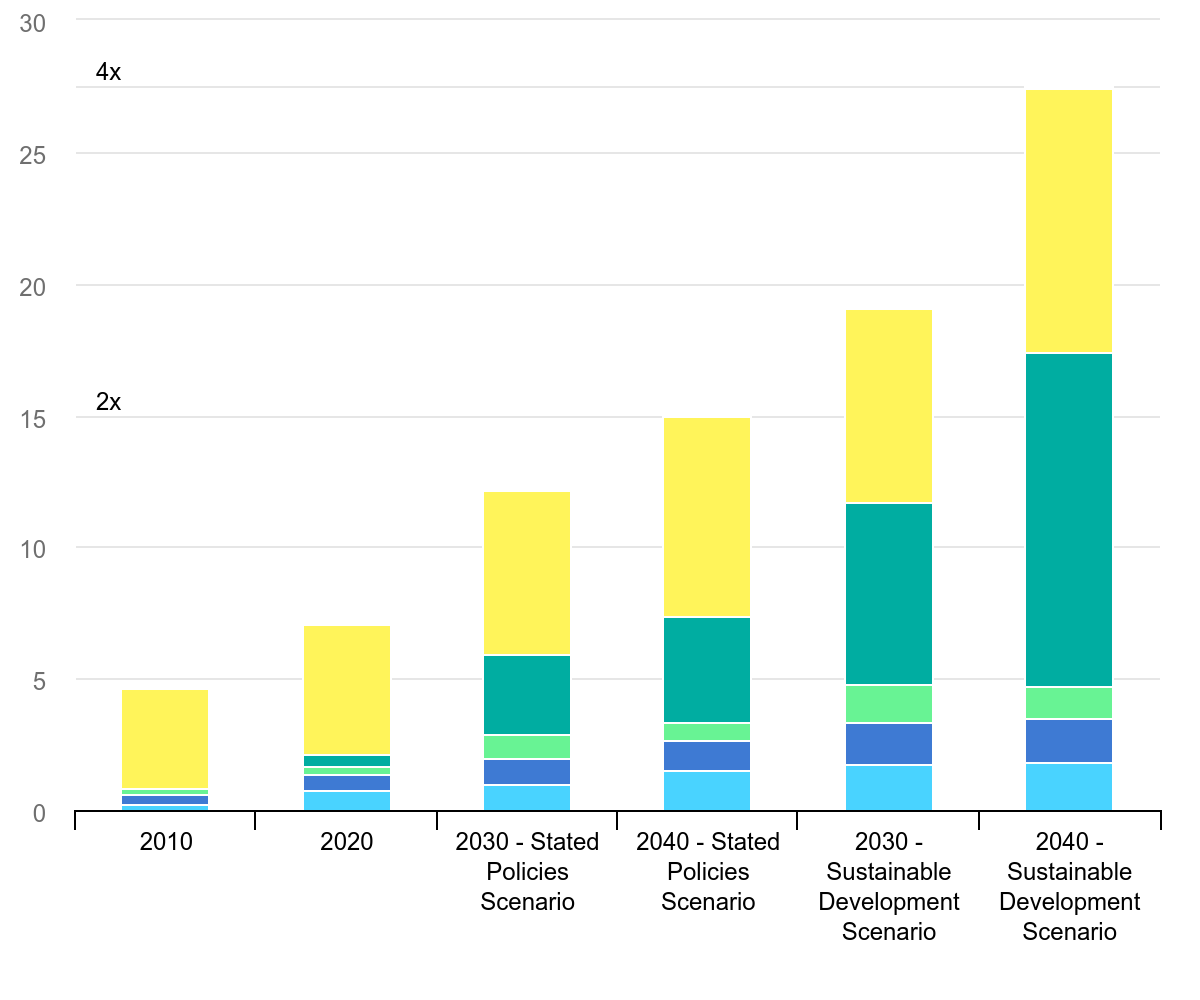

A shortage or price spike in these resources directly impacts clean energy goals and consumer markets. According to the International Energy Agency, demand for critical minerals is expected to quadruple by 2040 under clean energy scenarios.

IEA (2021), Total mineral demand for clean energy technologies by scenario, 2010-2040, IEA, Paris, Licence: CC BY 4.0

This makes mineral economics essential for forecasting demand, securing supply, and ensuring economic stability. Considering diverse perspectives in mineral economics helps address global challenges and supports balanced decision-making.

The History of Mineral Economics

Mineral economics emerged as a formal discipline in the 20th century when industrial growth created a need to understand resource management beyond geology and mining. Economists began applying financial models to assess mining investments, applying these models to establish parameters and standards for responsible mining practices and economic analysis. At the same time, governments created policies to regulate ownership, royalties, and exports.

The post-World War II boom in industrial activity created unprecedented demand for metals like steel, copper, and aluminum. This period demonstrated the need for resource planning and gave rise to mineral economics as an academic field.

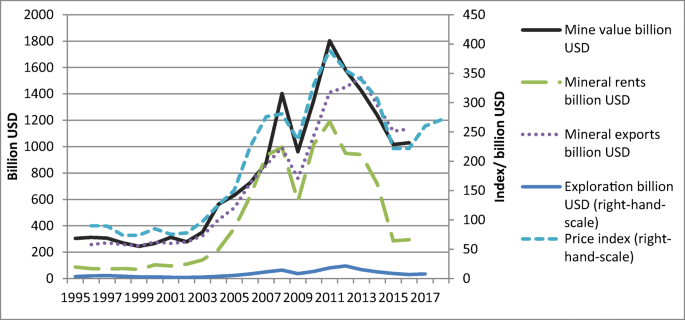

Mining’s contribution to national economies between 1996 and 2016

In the 1970s, the global energy crisis further emphasized the importance of linking resource management to economic planning, as fuel and mineral shortages revealed vulnerabilities in global supply chains. The response of mineral economics to these global changes included adapting policies and frameworks to address new challenges in resource allocation and sustainability.

Today, mineral economics has evolved to include sustainability, environmental policies, and the globalized nature of trade. It has become a critical discipline in universities and research centers, guiding policy decisions and investment strategies worldwide.

Key Areas of Focus in Mineral Economics

Mineral economics is multidisciplinary and covers diverse areas of study. One of the most critical areas is mineral market analysis, which involves studying demand, supply, pricing, and trade flows at both regional and global levels. Analysts use historical data, current consumption rates, and projected growth trends to anticipate future market dynamics.

Another central area is exploration and extraction economics. This focuses on evaluating the cost and efficiency of locating and extracting new resources. For example, the average price of discovering a new copper deposit has increased by nearly 300% since the 1980s due to declining ore grades and more complex geology. Mineral economics helps determine whether such projects remain financially viable.

Mineral pricing is also a core focus. The study of mineral pricing shows that prices fluctuate depending on factors such as extraction costs, global demand, supply availability, and government regulations. For instance, cobalt prices surged by more than 120% between 2016 and 2018 due to rising demand for electric vehicle batteries.

Sustainability and environmental policy have become increasingly important. With mining contributing to about 4–7% of global greenhouse gas emissions, mineral economics today emphasizes eco-friendly approaches, recycling, and urban mining as essential for the future.

Additionally, mineral economics helps identify opportunities for strategic growth and innovation, enabling stakeholders to recognize prospects for development and interdisciplinary collaboration within the mining and mineral economy sectors.

Mineral Resources and Industry

Mineral resources are at the heart of the world’s natural resources, fueling economic growth and industrial development across several countries. The mining industry, which encompasses everything from mineral exploration to processing and distribution, is a cornerstone of many national economies.

Mineral exploration is the first step in this value chain, involving the search for new mineral deposits that can meet the ever-growing demand for minerals in sectors such as construction, technology, and energy.

A robust mineral market analysis is essential for understanding the complex dynamics of the mining industry. This analysis helps industry practitioners, including mining companies, governments, and decision makers, to assess resource availability, forecast demand, and anticipate shifts in global supply chains.

The political implications of mineral resource distribution are significant, as countries with abundant mineral resources often wield considerable influence in international markets. In contrast, those with limited resources must navigate supply risks and price volatility.

Accurate data and ongoing research are vital for informed decision-making in the mining industry. By leveraging advanced analysis and up-to-date information, stakeholders can ensure the sustainable development of mineral resources, balancing economic growth with environmental and social responsibilities.

As the global demand for minerals continues to rise, the importance of strategic mineral exploration and market analysis will only increase, shaping the future of the industry and the economies of countries around the world.

Mineral Market Analysis: Understanding Global Dynamics

The global mineral market is vast and highly interconnected. Minerals are traded internationally, making them susceptible to global economic cycles, political instability, and technological change. For example, China currently controls more than 60% of the global rare earth element supply a number that represents a dominant share of the market and significant influence over industries such as electronics and renewable energy.

Demand for certain minerals is also shifting. The World Bank estimates that the production of minerals such as graphite, lithium, and cobalt could increase by nearly 500% by 2050 to meet demand for clean energy technologies. This creates both opportunities and challenges. While resource-rich nations may benefit economically, supply chain risks and environmental concerns will require careful management.

Market analysis also examines the role of major players, including multinational corporations like BHP, Rio Tinto, and Glencore, which dominate global mining operations. Their investment decisions and production strategies directly affect global supply and pricing.

Mineral Exploration and Extraction Economics

Exploration is a high-risk but necessary part of mineral economics. On average, fewer than one in every 1,000 exploration projects leads to a profitable mine. This makes economic modeling crucial for minimizing risks and guiding decision-making. Mineral economics provides frameworks for scoping, pre-feasibility, and feasibility studies that estimate the viability of projects.

Ore grades, technological efficiency, and environmental constraints influence extraction costs. For example, declining ore grades in gold and copper mining mean that companies must process more rock to obtain the same amount of metal, significantly increasing costs. Mineral economics helps identify the break-even point where extraction remains profitable despite these challenges.

In addition, compliance with regulatory frameworks, environmental standards, and ownership rights plays a vital role in determining whether exploration and extraction can proceed. These aspects are not only legal requirements but also economic considerations, as delays or disputes can cost companies millions of dollars.

Mineral Pricing: The Economics of Supply and Demand

Mineral pricing is not fixed but fluctuates based on multiple factors.

Demand and supply are the most fundamental. When supply is limited, as seen during cobalt shortages, prices can skyrocket. Conversely, oversupply, as with iron ore in the early 2010s, can lead to price crashes that destabilize economies dependent on mineral exports.

For example, the trade value of lithium carbonate reached over $70,000 USD per metric ton in 2022, highlighting how financial metrics and market valuation in USD are crucial in analyzing mineral commodities.

Extraction costs are another major driver. For instance, the cost of mining deep-sea minerals or processing low-grade ores is significantly higher than surface mining. These costs feed directly into market prices. Global economic health also plays a role; during economic recessions, demand for construction materials like steel and copper often drops, leading to price reductions.

Government regulations, such as royalties, taxes, and export restrictions, add another layer of complexity.

For example, Indonesia’s decision in 2014 to ban raw nickel exports led to sharp increases in global nickel prices, forcing companies worldwide to rethink supply chains.

Feasibility Studies in Mineral Economics

Feasibility studies are essential in applying mineral economics principles to real-world projects. Scoping studies provide preliminary financial predictions, often with an accuracy range of 30–50%, and help companies decide whether further exploration is justified.

Pre-feasibility studies are more detailed and integrate technical, environmental, and economic factors to identify the most viable options. Finally, feasibility studies represent the most comprehensive evaluation, with detailed engineering designs, cost structures, and projected profitability.

For example, Generation Mining’s Marathon Palladium-Copper Project in Canada underwent multiple feasibility assessments. The initial study showed limited profitability, but subsequent revisions incorporating more efficient designs and cost-saving measures demonstrated an internal rate of return of 25.8%.

This example underscores how mineral economics can transform project outcomes through rigorous analysis. In line with international frameworks, a recommendation by the NDICI suggests that feasibility studies should incorporate sustainability and access considerations to guide best practices in project evaluation.

Policy and Regulation in Mineral Economics

Policy and regulation are fundamental to the responsible management of mineral resources. Governments, as stewards of a country’s natural resources, play a pivotal role in shaping the framework within which the mining industry operates. Effective public policy must address a range of issues, from environmental protection and social justice to economic development and resource security.

The mining industry is subject to a complex web of regulations designed to mitigate environmental impacts, protect local communities, and ensure that mineral extraction contributes to sustainable development.

Decision makers must carefully balance the economic benefits of mining with the need to safeguard the environment and promote social equity. This often involves navigating policy issues such as land use, water rights, emissions standards, and community engagement.

Mineral economics research and analysis provide the evidence base for sound policy and regulatory decisions.

By understanding the economic, environmental, and social dimensions of mineral resource development, governments and industry leaders can craft policies that promote responsible mining, foster economic growth, and address the concerns of society.

As the world faces new challenges such as climate change and resource scarcity, the role of policy and regulation in mineral economics will become even more critical.

Research and Development in the Mineral Sector

Research and development (R&D) are the engines of innovation in the mineral sector, driving advancements in the extraction, processing, and sustainable use of mineral resources. The industry is constantly evolving, with new technologies and engineering solutions emerging to improve efficiency, reduce costs, and minimize environmental impacts.

Collaboration between academics, researchers, and industry practitioners is essential for expanding knowledge and understanding in mineral economics, geology, and engineering. Published papers and research studies offer valuable insights into the latest trends, from cutting-edge mineral exploration techniques to breakthroughs in mineral processing and environmental sustainability.

The scope of R&D in the mineral sector is broad, covering topics such as advanced exploration methods, automation in mining, waste reduction, and the development of eco-friendly processing technologies.

These innovations not only enhance the competitiveness of the mining industry but also support its transition toward greater sustainability. As global demand for minerals grows and environmental concerns intensify, ongoing research and development will be key to ensuring the responsible and efficient use of mineral resources.

Role of Mineral Economics in Global Trade and Development

Minerals play a central role in global trade. They are among the most heavily traded commodities worldwide, second only to energy resources. Countries rich in minerals can leverage them for export revenue, while those without must rely on imports, often at high costs.

For example, Australia earns close to 60% of its export revenues from mineral and energy resources, while Japan spends billions annually importing raw materials. Countries are often ranked based on their mineral output, trade influence, or research contributions, which reflect their position and prestige in the global market.

Mineral economics helps countries balance trade policies, build strategic reserves, and manage resource security. It also highlights risks that heavy reliance on imports can hinder economic stability, while over-dependence on exports can expose countries to global price volatility.

International collaboration and the research output by country play a significant role in shaping global mineral economics, influencing both policy and market trends.

Economic Benefits and Contributions of Mineral Industries

The mineral industries are powerful drivers of economic growth and development in several countries around the world. The mining industry generates significant revenue, creates jobs, and stimulates investment in infrastructure and related sectors. Minerals such as oil, gas, and metals are vital exports, providing essential foreign exchange earnings and supporting national economies.

The economic impact of the mineral sector extends far beyond the mines themselves. Mining activities spur growth in manufacturing, construction, and services, creating a multiplier effect that benefits entire economies. Mineral economics analysis is crucial for understanding these contributions, helping governments and industry leaders identify opportunities for further development and diversification.

Mineral industries also play a pivotal role in energy security, supplying key resources like coal, uranium, and rare earth elements that are essential for power generation and advanced technologies. As global demand for energy and minerals continues to rise, the economic significance of the mining industry will only increase, making it a cornerstone of development strategies in many countries.

Career Opportunities and Education in Mineral Economics

A career in mineral economics offers a wealth of opportunities for professionals interested in the intersection of mining, energy, finance, and public policy. Graduates in this field can pursue roles in mineral market analysis, policy development, research, consulting, and industry leadership. The demand for skilled professionals with expertise in mineral economics, geology, and engineering is strong, both in the private sector and within government agencies.

Universities and research institutions around the world offer specialized education and training programs in mineral economics, equipping students with the analytical, technical, and communication skills required to succeed in this dynamic field. Academics and researchers are also in high demand, contributing to the advancement of knowledge and the development of innovative solutions for the industry.

Whether working in mineral market analysis, advising on public policy, or conducting cutting-edge research, professionals in mineral economics play a vital role in shaping the future of the mining industry and ensuring the sustainable management of the world’s mineral resources.

With the ongoing evolution of the sector and the increasing importance of sustainability and technology, the field offers exciting prospects for those with the right skills and passion for making a difference.

Applications and Real-World Implications

The principles of mineral economics are applied daily in mining and trade. Companies use them to evaluate the profitability of new projects, governments rely on them to design tax and royalty regimes, and investors study them to forecast market opportunities.

Urban mining, or the recycling of electronic waste, is a growing application of mineral economics. For instance, one ton of discarded mobile phones can yield more gold than a ton of mined ore. This demonstrates how mineral economics supports both sustainability and profitability.

Recent Trends and Sustainability in Mineral Economics

In recent years, especially since March 2016, there has been a strong shift toward sustainable mining and eco-friendly operations. Artificial intelligence and advanced data analytics are now being used to improve exploration accuracy and optimize feasibility studies. Meanwhile, net-zero goals have prompted companies to reduce emissions in mining operations.

Urban mining and recycling are becoming integral to resource management, helping reduce waste and greenhouse gas emissions. According to PwC’s 2024 Mine Report, companies adopting sustainability practices are likely to outperform peers in both profitability and resilience.

The integration of Environmental, Social, and Governance (ESG) standards is another major trend. Mining companies are increasingly required to disclose their environmental footprint, community engagement, and governance structures as part of investment due diligence.

Conclusion

Mineral economics is more than a theoretical concept; it is a practical tool that guides governments, corporations, and investors in managing finite resources responsibly. By analyzing markets, exploration costs, pricing trends, and sustainability strategies, mineral economics ensures that minerals remain a foundation for development while minimizing environmental harm.

As the global economy shifts toward renewable energy and digital technologies, the importance of mineral economics will only grow. By understanding and applying its principles, stakeholders can prepare for a future where minerals are managed not just for profit but also for people and the planet.

Frequently Asked Questions (FAQ) about Mineral Economics

What is mineral economics?

Mineral economics is an interdisciplinary field that studies the economic aspects of mineral resources, including their discovery, extraction, pricing, trade, and sustainable management. It combines knowledge from economics, geology, engineering, and policy to ensure efficient and responsible use of mineral commodities.

Why is mineral economics important?

Mineral economics is crucial because minerals are finite resources that underpin modern industries such as construction, technology, and renewable energy. Understanding mineral economics helps manage supply chains, forecast demand, and develop policies that balance economic growth with environmental sustainability.

How does mineral economics affect global trade?

Minerals are widely traded internationally, making mineral economics essential for analyzing market dynamics, trade policies, and the geopolitical implications of resource distribution. Countries with abundant mineral resources can leverage them for economic growth, while others must manage import dependencies and price volatility.

What role does sustainability play in mineral economics?

Sustainability is a growing focus in mineral economics, emphasizing eco-friendly mining practices, recycling (urban mining), and reducing environmental impacts such as greenhouse gas emissions. Integrating sustainability helps ensure long-term resource availability and aligns mining activities with global climate goals.

What career opportunities are available in mineral economics?

Careers in mineral economics span mineral market analysis, policy development, research, consulting, and industry leadership. Professionals with expertise in economics, geology, and engineering are in demand across government agencies, mining companies, research institutions, and international organizations.

How are mineral prices determined?

Mineral prices fluctuate based on supply and demand, extraction costs, government regulations, and global economic conditions. Factors such as ore grade, technological advances, and geopolitical events also influence pricing.

What are feasibility studies in mineral economics?

Feasibility studies evaluate the economic viability of mineral projects, incorporating technical, environmental, and financial analyses. They help decision makers assess whether exploration and extraction projects should proceed.

How does mineral economics contribute to policy making?

Mineral economics provides data-driven insights that inform government policies on resource management, environmental regulations, taxation, and trade. Sound policies based on mineral economics help balance economic development with social and environmental responsibilities.

What is urban mining?

Urban mining refers to the recovery of valuable minerals from electronic waste and other recycled materials. It is an emerging area within mineral economics that supports sustainability by reducing reliance on traditional mining.

How does technology impact mineral economics?

Technological advancements improve exploration accuracy, extraction efficiency, and environmental management. Innovations such as artificial intelligence and data analytics are increasingly integrated into mineral economics research and industry practices.